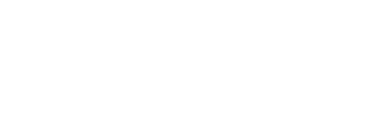

【海量案例】ChXX v ZhXXg [2016] NSWCA 1XX

[Note: The Uniform Civil Procedure Rules 2005 provide (Rule 36.11) that unless the Court otherwise orders, a judgment or order is taken to be entered when it is recorded in the Court's computerised court record system. Setting aside and variation of judgments or orders is dealt with by Rules 36.15, 36.16, 36.17 and 36.18. Parties should in particular note the time limit of fourteen days in Rule 36.16.]

JUDGMENT

McCOLL JA: I agree with Sackville AJA’s reasons and the orders his Honour proposes.

BASTEN JA: I agree with Sackville AJA.

SACKVILLE AJA: This is an appeal from a judgment of the District Court (Cogswell DCJ). The primary Judge entered judgment for the respondents against the appellant in the sum of $210,798.77 and made consequential orders.[1]

In 2012, the respondents and the appellant were members of a partnership which acquired an interest in a business known as “CaXXXr’s ChiXXXn Shop” conducted from premises located on Longueville Road, Lane Cove. The partnership acquired the interest in the business from the previous proprietor, CliXXXan Pty Ltd (CliXXXan), the sole director and sole shareholder of which was Mr ChXX. The primary Judge found that Mr ChXX made false misrepresentations to the respondents and that Mr ChXX’s misleading conduct induced them to sign a Licence Agreement by which the partners acquired the right to conduct the business. His Honour also found that the appellant, Mr ChXX, engaged in misleading or deceptive conduct in contravention of s 18(1) of the Australian Consumer Law (ACL)[2] and that his conduct was a cause of the respondents signing the Licence Agreement.

His Honour held that the respondents were entitled to recover from the appellant the amount of the loss or damage they had sustained in consequence of the appellant’s misleading conduct, pursuant to s 236(1) of the ACL. His Honour assessed the respondents’ loss to be the entirety of the amount they had paid as a licence fee to the previous proprietor to acquire their interest in the business.

The Legislation

Section 18(1) of the ACL, which is in Ch 2, provides as follows:

“A person must not, in trade or commerce, engage in conduct that is misleading or deceptive or likely to mislead or deceive.”

Section 236(1) of the ACL states that:

“If:

(a) a person (the claimant) suffers loss or damage because of the conduct of another person; and

(b) the conduct contravened a provision of Chapter 2...;

the claimant may recover the amount of the loss or damage by action against that other person...”

The ACL applies as a law of New South Wales by virtue of s 28(1) of the Fair Trading Act 1987 (NSW).

Background

The respondents, Mr and Mrs ZhXXg, are husband and wife. They speak Mandarin, Cantonese, Shanghainese and some English, but they cannot read documents in English. The appellant speaks Mandarin and Cantonese and apparently has some understanding of English. All three gave evidence at the trial with the assistance of interpreters.

On 9 October 2012, the respondents, the appellant and the appellant’s wife (Ms LXX) signed the Licence Agreement which conferred on them a licence to operate the chicken shop business. Although the Licence Agreement was signed on 9 October 2012, it was dated 19 September 2012. I refer to the four partners collectively as the Partners.[3]

The “Licensor” under the Licence Agreement was CliXXXan. The “licence fee” payable under the Licence Agreement was $420,000, of which $200,000 was payable as a non-refundable deposit. The balance of the licence fee was provided by way of vendor finance repayable over three years. The two sets of partners each contributed $100,000 to the deposit.

The Partners took over conduct of the business on 19 September 2012. The appellant and Ms LXX ceased working in the business on about 31 March 2013. The respondents continued to conduct the business, but left it in September 2013.

On 21 October 2013, the respondents commenced proceedings in the District Court claiming damages against CliXXXan and Mr ChXX as well as against the appellant and Ms LXX. Cross-claims were filed but these do not give rise to any issues on the appeal.

The critical allegation against the appellant is pleaded in para [44] of the respondents’ Amended Statement of Claim (ASC). Paragraph [44], which was amended during the District Court hearing, is as follows:

“In the period between 19 and 23 September 2012 [the appellant] represented to the [respondents] that the License [sic] Agreement recorded or gave effect to the terms recorded in the handwritten agreement.”

The reference to “the handwritten agreement” is to a document described in the ASC as:

“a four page document entitled ‘Facsimile Transmission’ addressed to [CliXXXan’s] solicitors...and dated 11 September 2012.”[4]

I refer to this document as the Handwritten Agreement.

The particulars to para [44] allege that:

“44.1 [The appellant] knew that the [respondents] could not read or write English;

44.2 [The appellant] knew that [the respondents] were reliant upon him to read the Licence Agreement to ensure its terms were substantially the same as the [H]andwritten Agreement.”

The representation is alleged to constitute misleading or deceptive conduct within the meaning of s 18(1) of the ACL because, relevantly, the Licence Agreement did not incorporate substantially the same terms as the Handwritten Agreement.[5]

Mr GiXXs SC, who appeared with Mr GrXXe for the respondents, accepted that the reference to the “period between 19 and 23 September 2013” in para [44] of the ASC is incorrect and that the date the appellant made the alleged misrepresentation was on or about 9 October 2012.

The Judgments and Orders

The primary Judge delivered three judgments. In the Primary Judgment, delivered on 22 June 2015, his Honour found that Mr ChXX engaged in misleading or deceptive conduct in that he told the respondents, wrongly, that the Licence Agreement was in substantially the same terms as the handwritten agreement. No issue concerning that finding arises in the appeal.

Of more significance for present purposes is his Honour’s finding that the appellant represented to the respondents, shortly before they signed the Licence Agreement, that they could act on the basis that the Licence Agreement recorded the terms that had been discussed when the Handwritten Agreement had been given to them. His Honour found that the appellant’s representation constituted misleading or deceptive conduct and that the respondents had relied on the appellant’s conduct when they proceeded to execute the Licence Agreement. His Honour accepted the respondents’ evidence that they would not have signed the Licence Agreement had Mr ChXX and the appellant not represented that it was in substantially the same terms as the Handwritten Agreement.

In the second judgment, delivered on 27 November 2015,[6] the primary Judge addressed several outstanding issues and made orders, including the following:

“4. Judgment for the [respondents] against [CliXXXan and Mr ChXX] in the sum of $147,559.14.

5. Judgment for the [respondents] against the [appellant] in the sum of $210,798.77.

6. The Court notes that the judgments in paras 4 and 5 are compensation for the same loss and any amount received in payment of either judgment shall reduce the amounts payable under both paras 4 and 5.”

These orders were duly entered.

The explanation for the different amounts in Orders 4 and 5 made by the primary Judge in the Second Judgment is that the damages awarded against CliXXXan and Mr ChXX were reduced by 30 per cent by reason of the respondents’ contributory negligence in failing to have the Licence Agreement read to them. The primary Judge had previously refused to permit the appellant to argue that there should be an apportionment of responsibility between CliXXXan and Mr ChXX and himself pursuant to s 87CD of the CC Act. His Honour held that as the appellant had not pleaded such a case, it was too late to raise the issue towards the conclusion of the proceedings.

In the third judgment, delivered on 18 January 2016,[7] his Honour dealt with costs. In this judgment, his Honour made orders in precisely the same terms as Orders 4 and 5 made on 27 November 2015. The additional orders made in the Third Judgment included Order 9(c), requiring the appellant to pay the respondents’ costs of the claim on the ordinary basis to 19 May 2014 and on an indemnity basis thereafter. For reasons that have not been explained, the orders made in the Third Judgment were entered, notwithstanding that some orders duplicated those already been made and entered on 27 November 2015.

The Second Amended Notice of Appeal filed by the appellant deals with the multiplicity of orders by seeking orders as follows:

“1. Appeal allowed.

1A. The orders made and entered in the proceedings below on 27 November 2016 be set aside.

2. Orders 5 and 6 and 9(c) of the orders...made in the proceedings below on 18 January 2016 be set aside.

....

6. The First and Second Respondents pay

(1) the Appellant’s cost of the Appeal herein;

(2) the Appellant’s cost of the proceedings below.”

Grounds of Appeal

The appellant abandoned at the hearing several grounds of appeal that were the subject of written submissions. In summary, the only grounds relied upon are as follows:

(1) The primary Judge erred in concluding that the statement made by the appellant to the respondents on or about 9 October 2012 was a representation that the Licence Agreement recorded the terms discussed at about the time the Handwritten Agreement was signed on 11 September 2012.

(2) Assuming that the appellant’s conduct was misleading or deceptive, the primary Judge erred in finding that the respondents suffered loss or damage because of the appellant’s conduct and should have found that they suffered no loss or damage.

The argument on the appeal proceeded on the basis that the Licence Agreement differed in material respects from the Handwritten Agreement. The appellant did not challenge the primary Judge’s finding that the essential difference was that the Handwritten Agreement contemplated a sale of the business to the Partners, while the Licence Agreement granted them only a licence to conduct the business.[8] It is not necessary to consider whether this finding was correct.

Course of Events

The following account is based largely on the primary Judge’s findings and uncontroversial evidence. However, I also refer to some matters which were the subject of disputed evidence.

In July 2012, CliXXXan entered into a written contract to sell the business known as “CaXXXr’s ChiXXXn Shop” to a Mr OmaXXXlou. At that time, CliXXXan leased the premises on which the business was conducted pursuant to the registered lease from the proprietor of the premises, ThoXXee Pty Ltd (Lessor). The lease was for a term of five years commencing on 12 September 2008 and expiring on 11 September 2013. The lease included options to renew for two successive five year periods.

The sale to Mr OmaXXXlou fell through because the Lessor refused to consent to an assignment of the lease to Mr OmaXXXlou. Mr ChXX seems to have proceeded thereafter on the assumption, not necessarily fully communicated to the Partners, that it would be difficult to obtain the Lessor’s consent to an assignment of the lease to purchasers of the business.

In August 2012, Mr ChXX and the Partners discussed the possible sale of the business to them. In early September 2012, the Partners agreed to purchase the business for $420,000. On 7 September 2012, the respondents paid Mr ChXX a deposit of $42,000 on behalf of the Partners. It appears that at this stage, no written agreement had been prepared or signed.

On 8 September 2012, what the primary Judge described as “the formal business partnership” was established, the members of which included the respondents’ son. The terms of the partnership agreement were not the subject of findings, but apparently each family was to have an equal share of the partnership.

On 11 September 2012, Mr ChXX gave the Handwritten Agreement to the appellant and respondents. The version of the document in the Appeal Books is not signed, but it is possible that the full document has not been reproduced. The Handwritten Agreement was sent by fax on the same day (11 September 2012) to CliXXXan’s solicitors. The cover sheet, addressed to the solicitors, named the respondents, the appellant and Ms LXX as the Partners.

The Handwritten Agreement, which was presumably prepared by Mr ChXX, set out in summary form the points that had been agreed between himself and the Partners. The Handwritten Agreement included the following terms (spelling and format as in original):

“CONDITIONS

A PRICES: $420,000 INCL STOCK NO GST

B ...

C lease: 1 + 5 + 5 (SAME CONDITIONS)

D Logo & CAESAR’S ChiXXXn Names: Same CONDITION as 1st Buyer (METIN)

E Deposit: $42,000 (paid) already to BXXl [Mr ChXX]

F Balance: $158,000 ON Settlement

G TOTAL Deposit: $200,000

Balance loan: $220,000 repay in 3 years

repayment: 1. year inTrest free

2. year 1.95% (market) as Bank varies

3 year 1.95% (market) as Bank varies

H. Vendor has 1st Option to Buy Back

...

K) Need ONE month rent paid a month advance.

...

M) THE Two partners must be paid off. The Balance, the BXXl may enquires the landlord to assign the lease

N) The partners must be stay until end of the lease and until the new option to start.

O) The partners must not replacement by New partners

P) The partner must paid all charges involved IN the Business

...

11/9/12”

Between 11 and 19 September 2012, the respondents paid a further $158,000 to CliXXXan (through Mr ChXX) on behalf of the Partners, making a total payment of $200,000. On 19 September 2012, the Partners began to operate the chicken shop. The appellant subsequently repaid $40,000 of the total of $100,000 the respondents had paid to Mr ChXX or CliXXXan on behalf of the appellant’s family.

At a meeting between Mr ChXX and the respondents at some time between 18 and 23 September 2012, Mr ChXX provided them with the Licence Agreement that had been drafted by CliXXXan’s solicitors. At that point, Mr ChXX had not spoken to the respondents since they and the appellant had discussed the Handwritten Agreement. Mr ChXX told the respondents that the Licence Agreement was in the same terms they had previously agreed to. He also told them that they should look at the document and return it to him when it was signed. It is not clear from the primary Judge’s findings whether this meeting took place before or after the respondents paid CliXXXan some or all of the $158,000 referred to above.

As I have noted, the Partners and the respondents’ son signed the Licence Agreement on 9 October 2012, although it was dated 19 September 2012. It was expressed to be between CliXXXan as “the Licensor” and the Partners (not including the respondents’ son) as “the Licensees”.

The recitals to the Licence Agreement were as follows:

“A. The Licensor is the proprietor of the business known as ‘Caesar’s ChiXXXn of Lane Cove’ (hereinafter referred to as ‘the Business’).

B. The Licensees are desirous of being granted a licence by the Licensor to operate the Business conducted at ... Lane Cove...

C. The Licensor at the request of the Licensee[s] has agreed to grant a licence to the Licensees to operate the Business for only a period of the duration of the existing lease to 31 August, 2015 on the terms and conditions set out hereunder.”

The evidence did not explain why the licence period was to expire on 31 August 2015. This was not the date the lease expired, nor was it the expiry date of a renewed lease created by an exercise of the option contained in the lease.

The Licence Agreement stated that the licence fee was $420,000, payable by a non-refundable deposit of $200,000 on the date of settlement, with the balance of $220,000 payable by monthly instalments over three years, the last payment being due on 31 August 2015. The Partners were also to pay “one month rental in advance”. The Licence Agreement did not state expressly, other than in Recital C, that the licence agreement would expire on 31 August 2015. That, however, was the evident intention, subject to the operation of cl 5, referred to below.

The Licence Agreement included the following additional provisions:

“5. Early repayment of the balance remaining is agreeable by the Licensor conditional upon the following:

(a) The Licensor received full payment of the balance of the licence fee remaining plus any interest accrued, and any rent and outgoings due but unpaid.

(b) The Licensor obtained consent from the Lessor (landlord) for assignment of lease to the licensees.

6. In the event of the Licensees wishing to sell the existing licence, the Licensor shall be given the first refusal. Thereafter any subsequent purchasers must first obtain written consent and approval from the Licensor.”

Curiously enough, the Licence Agreement did not expressly require the Partners to pay CliXXXan the rent it was obliged to pay the Lessor under the lease (other than the initial payment of one month’s rent). However, the Partners seem to have conducted themselves on the basis that the Partners were required to pay CliXXXan the rental and other outgoings due under the lease and that CliXXXan would make the payments due to the lessor.

According to Mr ChXX, from January 2013 the Partners began to fall behind in making the monthly rental payments due to CliXXXan. At that stage the rental under the lease was $9,274.66 per month plus GST, a total of $10,202.13. The Partners also paid the instalments due in respect of the licence fee.

On 19 March 2013, CliXXXan gave notice to the Lessor that it intended to exercise the option to renew the lease for a further term of five years. The Lessor refused to accept that the notice was valid because it had been served later than the date specified in the lease.

From 1 April 2013, the appellant and Ms LXX ceased to be involved in the business. The primary Judge made no findings as to why they ceased their involvement.

Mr ChXX apparently accepted that CliXXXan’s purported exercise of the option to renew the lease was invalid. In May 2013, he negotiated with the Lessor for the grant of a new lease of the premises. On 13 May 2013, the Lessor offered to enter into a new lease for five years from 12 September 2013 at a rental of $116,000 per annum plus GST. The proposed lease did not include any option to renew.

Ms ZhXXg gave evidence that she first learned in about May 2013 that the Licence Agreement merely licensed the Partners to operate the business and did not assign the business to them. She said that she became concerned because she had heard nothing about an assignment of the lease of the premises and asked an employee of the business to read and translate the Licence Agreement to her. It was then that she became aware of the terms of the Licence Agreement.

On 20 May 2013, Ms ZhXXg sent a text to Mr ChXX as follows (grammar and punctuation as in original):

“Hello, last week you give us the fax we do not understand,of the original lease for 11years,now how changed to 5 years?why? Please help us fight for additional lease. You know this is unfair to us.”

What negotiations then took place is not the subject of findings and the Appeal Books seem to omit some correspondence that may have shed light on why Mr ChXX and the respondents could not reach agreement. In any event, the primary Judge found that the respondents left the business on 9 September 2013. Two days later CliXXXan’s lease of the premises expired.

The Primary Judge’s Reasoning

The primary Judge dealt first with the respondents’ claim against CliXXXan and Mr ChXX. His Honour found that at a meeting between 18 and 23 September 2012, Mr ChXX gave the Licence Agreement to the respondents. Until that meeting, Mr ChXX had not spoken to the respondents since 11 September 2012, when they had discussed the Handwritten Agreement.[9]

The primary Judge accepted the respondents’ evidence that Mr ChXX told them that the Licence Agreement was “the agreement we talked about before”. His Honour found that even if Mr ChXX did not know the precise nature of the changes incorporated in the Licence Agreement, he knew that changes had been made. Nonetheless, he told the respondents that the Licence Agreement was in substantially the same terms as they had previously agreed.[10] His Honour also found that Mr ChXX’s assertion was misleading in the circumstances, given he knew that the respondents had not approached their lawyer and did not have time to do so.[11]

In considering the respondents’ claim against the appellant, the primary Judge identified the real issues to be “whether [Mr ChXX] made the express representation and whether it amounted to misleading conduct”.[12]

His Honour accepted Ms ZhXXg’s affidavit evidence that a conversation took place at the chicken shop on 9 October 2012, shortly before the respondents signed the Licence Agreement. The conversation involved the parties speaking a variety of languages, with the appellant acting as interpreter. The primary Judge found that the following exchange occurred:[13]

“[Mr ChXX]: ‘I came to chase up the agreement and to see if you have signed it. My solicitor is going on holidays and it needs to be signed today.’

[Ms ZhXXg]: ‘Yes, RXX [the appellant], have you had a look at it?’

[The appellant]: ‘I have been busy. I have not looked at it. Don’t worry, should be fine. [Mr ChXX] and I are friends for a long time.’

[Ms ZhXXg]: ‘Ok. You know, we are trusting you because we can’t read it ourselves.’

[The appellant]: ‘Yes, I know. Trust me there is nothing to worry about.’”

Ms ZhXXg’s oral evidence differed in some respects from her affidavit evidence but his Honour apparently preferred the account she gave in her affidavit.

The primary Judge then asked himself whether the representation amounted to misleading conduct contrary to s 18(1) of the ACL. He considered that the question could be refined to ask whether “the conduct [had] the tendency to lead [the respondents] into error”. His Honour continued as follows:[14]

“In my opinion it was misleading conduct and did have that tendency. That was because [the appellant] had not read the agreement. He was in business with [the respondents] and was relied on by [the respondents] because of his skill and experience and did not check that the document reflected the agreement they had reached with [Mr ChXX] to buy a business. I agree with [the respondents’] submission ... that [the appellant] ‘represented that [the respondents] could act on the basis that the document recorded the terms discussed on 11 September 2012’. I accept that [the respondents] relied upon [the appellant’s] conduct in signing the licence agreement. That is, as the High Court said in Sidhu v Van Dyke [2014] HCA 19; 251 CLR 505, the natural inference and that inference has not been rebutted by any evidence in this case. Not only that, but the circumstances described by [Ms ZhXXg] of the representation being made point to the likelihood of reliance. [The respondents] were in the business which they thought they had bought. They had not signed the formal document. They were being pressed to sign in it on that occasion. [The appellant] was there and they asked him the question, to which his response was misleading.” [Citation added.]

His Honour accepted Ms ZhXXg’s evidence that she would not have signed the Licence Agreement if Mr ChXX had told her that the Partners were to have only a licence to conduct the business, as distinct from a purchase of the business.[15] If she had been told the true position:

“she would want her money back and she said that she knew ‘[Mr ChXX] wouldn’t easily refund me so for sure we have to find a lawyer’.”

Having reached these conclusions about the respondents’ likely course of conduct, his Honour:

“therefore [found] that [the appellant’s] conduct misled [the respondents] into signing the [L]icence [A]greement and that any loss or damage suffered by them was because of that conduct.”[16]

Later in the Primary Judgment, his Honour referred to the “remedial smorgasbord” available where a contravention of s 18(1) of the ACL is established.[17] He indicated that he would need to hear further submissions from counsel on, among other issues, the quantum of damages payable by the appellant to the respondents.

In the Second Judgment, the primary Judge dealt very briefly with this issue. His Honour said that he agreed that the respondents should recover as loss or damage all payments made “because of” the conduct of CliXXXan, Mr ChXX and the appellant.[18] The orders made by the primary Judge indicate that he assessed damages by reference to the amounts paid by the respondents (to CliXXXan) in respect of the licence fees. Although none of the judgments recorded the calculations that produced the judgment sum of $210,798.77, I infer from the parties’ written submissions in the District Court that this sum comprised the respondents’ share of the deposit and of the monthly instalments paid between September 2012 and April 2013.

Reasoning

Misleading Conduct

The first question is whether the primary Judge erred in finding that the appellant engaged in misleading conduct by reason of his statements to the respondents on 9 October 2012.

Principles

In a claim based on a contravention of s 18(1) of the ACL, it is necessary to identify the contravening conduct and to determine whether there is a causal connection between the conduct and the loss or damage allegedly suffered by the claimant.[19] That requires a sufficient link to be established between the misleading conduct and errors made by persons exposed to the conduct.[20]

As French CJ pointed out in Campbell v Backoffice Investments Pty Ltd,[21] the question of whether conduct is misleading or deceptive within the meaning of s 18(1) is logically anterior to the question of whether a person has suffered loss or damage thereby. An answer to the first question generally requires consideration of whether the impugned conduct as a whole has a tendency to lead a person into error.[22] Where the conduct involves dealings between individuals, as in the present case, characterisation of the conduct requires objective consideration of the circumstances and context of the impugned conduct, which may include the knowledge of the person to whom the conduct is directed.[23]

McHugh J explained in Butcher v Lachlan Elder Realty Pty Ltd,[24] in reference to a document said to be misleading or deceptive, that:

“The question whether conduct is misleading or deceptive or is likely to mislead or deceive is a question of fact. In determining whether a contravention of s 52 [of the Trade Practices Act 1974 (Cth)[25]] has occurred, the task of the court is to examine the relevant course of conduct as a whole. It is determined by reference to the alleged conduct in the light of the relevant surrounding facts and circumstances. It is an objective question that the court must determine for itself. It invites error to look at isolated parts of the corporation's conduct. The effect of any relevant statements or actions or any silence or inaction occurring in the context of a single course of conduct must be deduced from the whole course of conduct. Thus, where the alleged contravention of s 52 relates primarily to a document, the effect of the document must be examined in the context of the evidence as a whole. The court is not confined to examining the document in isolation. It must have regard to all the conduct of the corporation in relation to the document including the preparation and distribution of the document and any statement, action, silence or inaction in connection with the document.” [Citations omitted.]

It is, however, important to appreciate that whether or not a person contravenes s 18(1) of the ACL is not necessarily answered simply by asking whether the person’s conduct in fact misled someone else, although evidence to that effect might be significant.[26] Misleading conduct may take many forms and is not confined to representations.[27] But in a case where the impugned conduct is said to consist of representations, the question of whether the conduct was misleading or deceptive ordinarily must be determined by what a reasonable person in the position of the representee would have made of the representations, taking into account all relevant circumstances.[28]

It is true that there may be cases which turn on what the representee makes of the representations, whether or not the representee acts reasonably. The majority in Butcher v Lachlan Elder Realty Pty Ltd gave as an example a case where a representor with commercial expertise knows that the representee has limited experience and is acting without professional advice in rushed circumstances.[29] Nonetheless, the impugned conduct viewed as a whole must be capable of leading the representee into error.[30]

The Present Case

It will be recalled that the primary Judge found that the appellant made a misleading representation to the respondents at the meeting of 9 October 2012, shortly before the Partners signed the Licence Agreement. On his Honour’s findings, Ms ZhXXg asked the appellant whether he had looked at the Licence Agreement. The appellant’s answer was:

“I have been busy. I have not looked at it. Don’t worry, should be fine. BXXl [Mr ChXX] and I are friends for a long time.” [Emphasis added.]

Ms ZhXXg then said the respondents were trusting the appellant because they could not read the document themselves. The appellant’s response to this comment was:

“Yes, I know. Trust me there is nothing to worry about.”[31]

By making these statements to the respondents, the appellant might be taken to have represented that he believed Mr ChXX to be an honest person and that his involvement in the transaction meant that there was nothing to worry about. Perhaps the appellant might be taken to have made other representations concerning Mr ChXX’s trustworthiness. But the respondents’ only pleaded allegation was that the appellant represented to them that the Licence Agreement recorded or gave effect to the terms recorded in the Handwritten Agreement.

The appellant, in the conversation found by the primary Judge to have occurred, expressly stated that he had not looked at the Licence Agreement. In view of this unequivocal disclaimer, the appellant’s assurance to the respondents cannot be interpreted as a representation in or to the effect of that pleaded in the ASC.[32] If, as the appellant told the respondents, he had not read the Licence Agreement, he simply could not have known whether it was in substantially the same terms as the Handwritten Agreement. There is nothing in the evidence or findings to suggest that the respondents were unable to understand what the appellant was telling them. In these circumstances, they could not reasonably have understood the appellant to be representing to them that the Licence Agreement incorporated substantially the same terms as the Handwritten Agreement. The respondents did not suggest that the appellant said or did anything else to convey the representation pleaded in the ASC.

Mr GiXXs attempted to overcome these difficulties by emphasising that the respondents were unable to read the Licence Agreement and were reliant on the appellant. So much may be accepted. But neither point demonstrates that the appellant made the representation alleged by the respondents or that they could reasonably have understood the appellant to be making any such representation. Nor do they demonstrate that the respondents relied on what the appellant told them for any purpose other than (perhaps) to form a belief that Mr ChXX was honest and that his involvement indicated that there was nothing to worry about.

The primary Judge appears to have assumed that Ms ZhXXg interpreted the appellant’s assurance that there was nothing to worry about to mean that the Licence Agreement contained the same terms as the Handwritten Agreement. It is true that Ms ZhXXg said in her affidavit that she thought she was signing “a purchase agreement that was...in the exact same terms as the Handwritten Agreement”. However, she did not say that she understood the appellant to be assuring her or Mr ZhXXg that the Licence Agreement and the Handwritten Agreement were in substantially the same terms. Nor did she give oral evidence that this was her understanding of the appellant’s comments.

There is, in my opinion, nothing very surprising about this gap in the evidence. The evidence is entirely consistent with Ms ZhXXg believing when she signed the Licence Agreement that it was substantially the same as the Handwritten Agreement, yet not having understood the appellant to have made a representation to that effect. The primary Judge’s findings indicate that Ms ZhXXg formed her belief about the contents of the Licence Agreement before the meeting on 9 October 2013 took place.

On the primary Judge’s findings, some two weeks before the respondents signed the Licence Agreement, Mr ChXX assured them that the document was in exactly the same terms as had been discussed when the Handwritten Agreement was prepared. Mr ChXX’s representation was “clearly a cause of [the respondents] entering into the [L]icence [A]greement”, although another contributory cause was the respondents’ failure to have the Licence Agreement read to them or checked.[33] On these findings, the respondents must have come to the meeting on 9 October 2012 already believing that the Licence Agreement was in substantially the same terms as the Handwritten Agreement.

The appellant said nothing to the respondents that could reasonably have been understood by them (or, on the evidence, was understood by them) as making the same representation Mr ChXX had made two weeks or so before they signed the Licence Agreement. Nor did the primary Judge find that the appellant believed that the respondents interpreted his comments to be an assurance that the two documents were substantially the same. What the appellant told the respondents was something different, namely that although he had not read the Licence Agreement, he and Mr ChXX had been friends for a long time and the respondents had nothing to worry about.

Whatever representations may have been conveyed by the appellant’s statements, they did not include the representation the respondents pleaded and relied on. The fact that the respondents were at a disadvantage because they could not read the Licence Agreement does not justify a finding that the appellant misled them about the contents of the Licence Agreement.

For these reasons, the primary Judge erred in finding that the appellant engaged in misleading or deceptive conduct in the manner alleged by the respondents.

Damages

Since I have concluded that the primary Judge erred in finding that the appellant engaged in misleading or deceptive conduct, the issue of damages does not arise for decision. Nevertheless, I shall briefly explain why, in my view, the primary Judge erred in awarding the respondents damages equivalent to the amounts paid by them to CliXXXan to acquire their interest in the business.

Mr GiXXs supported the primary Judge’s award of damages on the ground that the “correct counterfactual ... is that [but for the representation the respondents] would not have entered into a contract with CliXXXan”. They would have left the business and demanded their money back (although Ms ZhXXg acknowledged that Mr ChXX and CliXXXan were very likely to resist and that the respondents would have engaged a lawyer). On this basis, so Mr GiXXs argued, his Honour was entitled to hold that the loss caused by the appellant’s misleading conduct was the amount they paid to CliXXXan as a deposit and on account of what the Licence Agreement characterised as a “licence fee”.

Two Difficulties

One difficulty with the primary Judge’s approach is that he made no findings as to why the respondents gave up the business shortly before CliXXXan’s lease of the premises expired, thereby losing their entire investment. Did they do so because the business was proving less profitable than they had expected (a matter not the subject of any misleading conduct)? Was it because, as some of Mr ChXX’s evidence suggested, they thought that the business was unsuitable for their son? Was it because they expected to receive or have the benefit of a lease for a further ten years after 11 September 2013 but realised that Mr ChXX was only able to obtain the Lessor’s agreement to a grant of a fresh lease for a single term of five years? If so, why did they apparently consider Mr ChXX’s proposal to be unacceptable? If they had accepted his proposal, could they have continued to operate the business and, if so, what would it have been worth at the commencement of the new lease? None of these matters was the subject of findings.

A second difficulty is that in assessing damages, the primary Judge did not advert to the fact that the respondents paid at least $100,000 to CliXXXan well before the appellant made his comments to the respondents on 9 October 2012. The fact that this payment and at least one instalment of the licence fee pre-dated (what I am assuming to be) the appellant’s misleading conduct would not necessarily prevent the respondents establishing the required causal relationship between the conduct and the respondents’ loss of these amounts. However, there might well be an issue as to whether or not the respondents were contractually obliged to make the payments that pre-dated their entry into the Licence Agreement. If, for example, the Handwritten Agreement recorded the terms of a binding contract between CliXXXan and the Partners (a proposition Mr LyXXh advanced) it might be difficult to conclude that the respondents’ execution of the Licence Agreement caused the loss of the sums the respondents had previously paid to CliXXXan. The primary Judge made no findings to whether the Handwritten Agreement recorded the terms of a binding contract, but that appears to be because neither party asked him to do so.

Principles

It can be accepted, as the respondents submitted, that the primary Judge was not obliged to limit the damages payable by the appellant for his (assumed) misleading conduct to the difference between the price the respondents paid for the asset they acquired and the true value of that asset at the date of acquisition. The High Court in HTW Valuers (Central Qld) Pty Ltd v Astonland Pty Ltd[34] made it clear that the so-called “rule” in Potts v Miller,[35] which has sometimes been understood to impose such a limitation, is “not universal or inflexible or rigid”.

In ABN AMRO Bank NV v Bathurst Regional Council,[36] the Full Federal Court summarised the position as follows:

“First, [the claimant has] the burden of proving its loss or damage. Second, subject to the loss being proved, the approach to assessment must be flexible and ‘best adapted to give the injured claimant an amount which will most fairly compensate for the wrong suffered’ provided that it works no injustice. Third, causation and damages are closely linked. Fourth, and no less importantly, where property has been acquired in reliance on misrepresentations, there will be many cases where the losses are not represented by the difference between the price and the value of the asset at the time of purchase. The circumstances in which that last group of cases might arise are not closed.” [Citations omitted.]

The rejection of a rigid approach to the assessment of damages does not mean that a claimant who is induced to acquire an asset by misleading conduct establishes an entitlement to recover the full price paid merely by proving that he or she would not have acquired the asset but for the misleading conduct. Nor does the claimant necessarily establish such an entitlement by proving that the asset has ultimately become worthless.

In assessing the damages that fairly compensate a claimant for the loss sustained by reason of the misleading conduct, it is necessary to separate out losses resulting from “extraneous factors” or supervening causes. As Dixon J said in Potts v Miller,[37] in relation to a claim based on a misrepresentation inducing the purchase of shares, it is:

“necessary to distinguish between the kinds of cause occasioning the deterioration or diminution in value. If the cause is inherent in the thing itself, then its existence should be taken into account in arriving at the real value of the shares or other things at the time of the purchase. If the cause be ‘independent,’ ‘extrinsic,’ ‘supervening’ or ‘accidental,’ then the additional loss is not the consequence of the inducement.”

This principle applies to claims for damages based in contraventions of s 18(1) of the ACL.[38]

The present case

In this case, the primary Judge made no findings that justify concluding that the asset acquired by the respondents lost its entire value by reason of execution of the Licence Agreement. It is by no means clear, for example, that the Handwritten Agreement contemplated that the lease would be assigned to the Partners, as distinct from CliXXXan continuing as lessee of the premises and permitting the Partners to operate the chicken shop. If that is the case, the Partners were always at risk of the lease not being renewed by CliXXXan, as in fact occurred. The time for exercising the option expired on 11 March 2013, well before execution of the Licence Agreement, and Mr ChXX’s failure to give notice on time seems to have had nothing to do with the terms of the Licence Agreement.

More importantly, as I have noted, the primary Judge made no findings as to why the respondents apparently chose not to accept CliXXXan’s proposal that they remain in possession of the chicken shop for the further term of five years the Lessor was prepared to grant CliXXXan. Nor did his Honour make findings as to why the respondents decided to give up possession of the shop. In the absence of findings as to these matters, the respondents have not established that the loss of the entirety of the deposit and licence fees paid by them was attributable to any misleading conduct by the appellant. The evidence appears to be consistent with the total loss of the licence fee being attributable to “extraneous” or supervening factors unconnected with any disparities between the terms of the Handwritten Agreement and those of the Licence Agreement.

For these reasons, if it had been necessary to decide, I would have concluded that the primary Judge’s assessment of damages had to be set aside. Whether the consequence would be that the respondents’ claim would be dismissed or the matter remitted for a further hearing in the District Court was not the subject of argument and need not be decided.

Orders

The appeal must be allowed. I propose the following orders:

(1) Appeal allowed.

(2) Orders 5 and 6 made on 27 November 2015 be set aside.

(3) Orders 5, 6 and 9(c) made on 18 January 2016 be set aside.

(4) In lieu thereof, order that the Respondents’ claim against the Appellant be dismissed.

(5) The Respondents pay the Appellant’s costs of the Respondents’ claim in the District Court against the Appellant.

(6) The Respondents pay the Appellant’s costs of the appeal.

(7) The Respondents have a certificate under the Suitors’ Fund Act 1951 (NSW).

**********

[1] ZhXXg v CliXXXan Pty Ltd (unrep, 22 June 2015, District Court) (Primary Judgment).

[2] The ACL is in Sch 2 of the Competition and Consumer Act 2010 (Cth) (CC Act).

[3] The Licence Agreement was also signed by the respondents’ son, who had become a member of the partnership prior to the execution of the Licence Agreement. The son was not joined as a party to the respondents’ claim against the appellant, although he was a party to the District Court proceedings, having been joined as a cross-defendant to a cross-claim. No point was taken about the son’s non-joinder to his parents’ claim. He is not a party to the appeal and, given the way the case has been conducted, nothing turns on his admission to the partnership.

[4] ASC, the particulars to para [12].

[5] ASC paras [18], [47]. Although the ASC does not refer to s 28(1)(c) of the Fair Trading Act 1987 (NSW), the respondents need to rely on that provision. Section 131 of the CC Act applies the ACL as a law of the Commonwealth to the conduct of corporations, but the appellant is not a corporation: see at [6] above.

[6] ZhXXg v CliXXXan Pty Ltd (unrep, 27 November 2015, District Court) (Second Judgment).

[7] ZhXXg v CliXXXan Pty Ltd (unrep, 18 January 2016, District Court) (Third Judgment).

[8] Primary Judgment at [70]-[73].

[9] Primary Judgment at [56].

[10] Primary Judgment at [58].

[11] Primary Judgment at [59], [61].

[12] Primary Judgment at [68].

[13] Primary Judgment at [68].

[14] Primary Judgment at [69].

[15] Primary Judgment at [71].

[16] Primary Judgment at [74].

[17] Primary Judgment at [99], referring to Akron Securities Ltd v Iliffe (1997) 41 NSWLR 353 at 364 (Mason P).

[18] Second Judgment at [15].

[19] Campbell v Backoffice Investments Pty Ltd [2009] HCA 25; 238 CLR 304 at [102] (Gummow, Hayne, Heydon and Kiefel JJ).

[20] Australian Competition and Consumer Commission v TPG Internet Pty Ltd [2013] HCA 54; 250 CLR 640 at [39] (French CJ, Crennan, Bell and Keane JJ) (“ACCC v TPG Internet Pty Ltd”).

[21] [2009] HCA 25; 238 CLR 304 at [24].

[22] Campbell v Backoffice Investments Pty Ltd at [24] (French CJ); ACCC v TPG Internet Pty Ltd at [49].

[23] Campbell v Backoffice Investments Pty Ltd at [25].

[24] [2004] HCA 60; 218 CLR 592 at [109], approved in Campbell v Backoffice Investments Pty Ltd at [102].

[25] The predecessor to s 18(1) of the ACL.

[26] Poulet Frais Pty Ltd v Silver Fox Co Pty Ltd [2005] FCAFC 131; 220 ALR 211 at [75] (per curiam).

[27] Campbell v Backoffice Investments Pty Ltd at [102]; Butcher v Lachlan Elder Realty Pty Ltd at [103].

[28] Poulet Frais Pty Ltd v Silver Fox Co Pty Ltd at [76], [78].

[29] [2004] HCA 60; 218 CLR 592 at [50] (Gleeson CJ, Hayne and Heydon JJ).

[30] ACCC v TPG Internet Pty Ltd at [49].

[31] See at [48] above.

[32] See at [13]-[14] above.

[33] Primary Judgment at [62].

[34] [2004] HCA 54; 217 CLR 640 at [35] (per curiam).

[35] [1940] HCA 43; 64 CLR 282.

[36] [2014] FCAFC 65; 224 FCR 1 at [963].

[37] [1940] HCA 43; 64 CLR 282 at 298.

[38] Henville v Walker [2001] HCA 52; 206 CLR 459 at [24]- [25] (Gleeson CJ), cited with approval at HTW Valuers (Central Qld) Pty Ltd v Astonland Pty Ltd at [65].

SEARCH CONTEXT

Show context

Hide context

Print (pretty)

Print (eco-friendly)

DOWNLOAD

RTF format (324 KB)

Signed PDF/A format

CITED BY

LawCite records

NoteUp references

JOIN THE DISCUSSION

Tweet this page

Follow @AustLII on Twitter

1300 91 66 77

1300 91 66 77

首页

首页