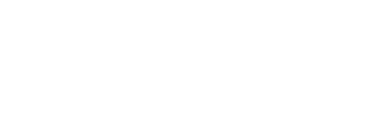

【海量案例】ChXXg v ChaXXll (No 2) [2009] NSWSC 1XX6

IN THE SUPREME COURT

OF NEW SOUTH WALES

EQUITY DIVISION

BRERETON J

Friday, 18 September 2009

2XX9/07 QinXXi ChXXg v JXXe HaXXy ChaXXll & AnXX

JUDGMENT (ex tempore)

1 HIS HONOUR: On 25 May 2009 I gave judgment in these proceedings concluding that the plaintiff QinXXi ChXXg was entitled to judgment against the first defendant JXXe HaXXy ChaXXll for certain sums of money of which $1,052,963 was traceable into Ms ChaXXll’s property at XX Bayview Street, Tennyson Point, for which amount the plaintiff was entitled to a charge on the Tennyson Point property. I adjourned the proceedings for short minutes and on 28 May made orders in accordance with short minutes of that date relevantly as follows:

1. Declare that the first defendant holds the property comprised in Certificate to Title Folio Identifier Lot 1XX Deposited Plan XX03228 being the land situate at XX Bayview Street, Tennyson Point in the state of New South Wales subject to and charged with payment of the sum of one million and fifty two thousand nine hundred and sixty three dollars (1,052,963 AUD) together with interest on the same up to the date of judgment in the sum of four hundred and thirteen thousand five hundred and forty nine Australian dollars (413,549 AUD) and interest in accordance with Schedule 5 to the Civil Procedure Rules

2005 from the date of judgment up to the date of discharge of the liability.

2. Give Judgment for the plaintiff against the defendant in the sum of six million six hundred and nineteen thousand and eighty six Australian dollars (6,619,086.00 AUS) (which sum includes the principal sum and interest declared to be secured against the land and pursuant to the Declaration made in paragraph 1).

3. Give Judgment for the plaintiff against the first defendant in the sum of five hundred and twelve thousand one hundred and ten United States Dollars (512,110 USD).

4. Order that the proceedings against the second defendant are dismissed.

5. Order that the land comprised in Certificate if Title Folio Identifier Lot 1XX Deposited Plan XX03228 being the land situates at XX Bayview Street, Tennyson Point in the state of New South Wales be sold subject to the supervision of the Court (“the land”).

6. Order that the plaintiff to have the conduct of the sale including power to enter into a contract for sale of the land and to execute a Transfer in his own name to be signed by him or by his attorney.

7. Order that the plaintiff be entitled to sell the land by either public auction or tender or private treaty but subject to the approval of the court of the price in the event that the property is sold by private treaty.

8. Order that the plaintiff pay and apply the proceeds of the sale of the land in the following order: firstly as to Westpac Banking Corporation to the extent necessary to discharge the amount secured by registered mortgage number 9562239 and secondly in payment of legal costs, fees and disbursements of and incidental to the sale including real estate agent’s fees and disbursements in relation to acting on the sale.

9. Order that upon the sale of the land and disbursement of the proceeds of sale thereof as set out in Order 8 herein the plaintiff shall hold and may pay to himself the balance of the proceeds for himself sufficient to discharge the monies secured on the land by the charge referred to in the Declaration in paragraph 1.

10. Order that upon payment of all monies referred to in paragraphs 8 and 9 herein the plaintiff shall be entitled to appropriate from the balance of the proceeds of the sale of land by way of execution up to the balance of the amount under the Orders.

…

17. Grant liberty to apply to the Court in the event of any difficulties arising in connection with the sale of the land.

2 In pursuance of the orders of 28 May, QinXXi ChXXg has set about conducting the judicial sale of the property. On or about 11 June 2009, the second defendant HXXg WXX WX lodged a caveat in respect of the Tennyson Point property, No AE737XX0N, claiming “equitable interests” by virtue of the facts and on the basis of contribution of moneys at the time of the purchase of the property and non-monetary contributions to the improvement of the property. Having discovered the existence of the caveat QinXXi ChXXg has formed the view, reasonably enough, that it presents an impediment to any prospective sale. His solicitors requested its removal. HXXg WXX WX’s solicitors responded that they were instructed not to remove the caveat.

3 There are proceedings in the Family Court of Australia between Ms ChaXXll and HXXg WXX WX for the adjustment and settlement of property interests between them. HXXg WXX WX contends that, if the caveat were removed, his claim to a interest in the Tennyson Point property will effectively be defeated, and his claim in the Family Court proceedings with it. By the present application, QinXXi ChXXg claims, and HXXg WXX WX opposes, an order pursuant to the (NSW) Real Property Act 1900, s 74MA, for the withdrawal of HXXg WXX WX’s caveat.

4 On such an application, it is well established that the caveator bears the onus of sustaining the caveat, and that the test is substantially equivalent to that which applies on an application for an interlocutory injunction in that the caveator must show, first, a seriously arguable claim to a caveatable interest which would entitle the caveator to an injunction prohibiting the proposed dealing, and secondly, that the balance of convenience favours the retention of the caveat. However, while the balance of convenience is a relevant consideration on such an application, it is an exceptional case in which, on balance of convenience considerations, the Court will remove an otherwise valid caveat. Thus, one distinction between an ordinary application for an interlocutory injunction and an application for removal or extension of a caveat is that in the latter class of applications, establishing a seriously arguable claim to a caveatable interest having priority over the competing interest, is often decisive and usually of more importance than the balance of convenience.

5 In this case, it can be said at the outset that the balance of convenience, if viewed on its own, would plainly favour allowing the caveat to remain. That is because, if I were wrongly to allow the caveat to remain until ultimate determination of all matters in issue, the long-term rights of the parties would be unaffected: the property would be preserved; it would remain available to satisfy HXXg WXX WX’s claimed interest in it; and no one would suffer undue prejudice; while there would be some delay in enforcement of QinXXi ChXXg’s rights under the judgment, delay is a minor matter when compared to the total destruction of rights. On the other hand, if I were wrongly to remove the caveat, the property would then be sold, the proceeds appropriated by QinXXi ChXXg, and HXXg WXX WX’s claimed interest would be destroyed forever.

6 Accordingly, whether HXXg WXX WX has a seriously arguable claim to a caveatable interest having priority over QinXXi ChXXg’s interest is fundamental to the outcome of this application. Based on the affidavit evidence of HXXg WXX WX, it can be said that he has a seriously arguable claim to an equitable interest in the Tennyson Point property, arising from his claimed contributions, said to be $380,000, to the purchase price and costs of acquisition, of the property which was purchased for $2.4 million in April 2004 in the sole name of Ms ChaXXll his wife, allegedly because she was an Australian citizen, whereas he was not a permanent resident and could not be placed on title. Those facts are, in my view, ample to show an arguable claim to a resulting trust or Baumgartner trust, there being some basis for supposing that the presumption of advancement could be rebutted. Although the drafting of the caveat is inelegant, the description of the facts on which it relies is sufficient to make tolerably clear that the claim is one of an interest arising by way of resulting trust or Baumgartner trust.

7 The decisive question is whether there is a sufficiently arguable case that such interest would have priority over QinXXi ChXXg’s interest.

8 In the amended statement of claim, QinXXi ChXXg pleaded that Ms ChaXXll was the registered proprietor of the Tennyson Point property, subject to a registered first mortgage in favour of Westpac, and that from the moneys advanced to her by him, she paid in reduction of the Westpac mortgage a sum of $1,052,963.54. That is the amount the subject of paragraph 1 of the orders of 28 May.

9 By way of relief, QinXXi ChXXg claimed a declaration that he had an equitable charge over the Tennyson Point property securing repayment to him by Ms ChaXXll of that sum, and an order for judicial sale of the property providing for application of the proceeds:

after payment to the first mortgagee of the moneys due to it pursuant to the mortgage registered on title that there be paid from the balance remaining the costs of sale including real estate agent’s commission, fees and disbursements and legal fees and disbursements on sale and to the plaintiff the amount secured by the said charge with the balance to be held for the first defendant subject to such other charges or equities as may otherwise exist.

10 The orders of 28 May, in paragraph 5 and following, give effect to the charge declared in paragraph 1. In particular, order 9 reflects a conclusion that QinXXi ChXXg’s charge ranked in priority after the Westpac mortgage and before the interests of the beneficial owners. Paragraph 10, on the other hand, deals with the recovery of QinXXi ChXXg by way of execution of such of the judgment in his favour as was not secured on the Tennyson Point property, and is an unsecured debt due to him.

11 The property is said to be worth at least $2.4 million. The amount due to Westpac under the mortgage is said to be about $1.1 million. The amount due to QinXXi ChXXg under the charge – putting to one side, for the moment, his unsecured debt – is just over $1 million. It is, therefore, quite conceivable that after discharge of the Westpac mortgage and QinXXi ChXXg’s charge, there may well be a surplus available.

12 The purpose of my reference to the amended statement of claim, the claims for relief in it and the pleadings in it, is to show that the claim for a charge and orders to give effect to it were live issues on the pleadings and in the proceedings. HXXg WXX WX, therefore, had an opportunity to answer QinXXi ChXXg’s claim, not only that he had a charge over the Tennyson Point property, but also that any such interest should be satisfied in priority after the costs of sale and the Westpac mortgage. According to the principles discussed by the High Court in Port of Melbourne Authority v Anshun Pty Ltd (1981) 147 CLR 589, if HXXg WXX WX wished to argue that he had a beneficial interest, or at least one that had priority over QinXXi ChXXg’s beneficial interest, he was bound to bring that argument forward, if ever, in the course of these proceedings. That this is such a case can be seen from the circumstance that if such a claim were now to be sustained it would result in the Court necessarily having to make orders inconsistent with those already made in these proceedings – to which HXXg WXX WX was a party – by providing for some other interest to be satisfied before satisfaction of QinXXi ChXXg’s charge. Primarily on that ground, in my view it is now too late for HXXg WXX WX to assert that he has a beneficial interest in the property ranking in priority to QinXXi ChXXg’s charge. An additional reason – not necessary to my decision but supportive of it – is that it is at least strongly arguable that because QinXXi ChXXg’s funds advanced to Ms ChaXXll were applied by her in reduction of the Westpac mortgage, his charge would take priority by subrogation to Westpac’s position, and if it be the case, as seems likely, that the Westpac mortgage was given upon and to fund the purchase of the property, it would prevail over the beneficial interest of HXXg WXX WX, on that ground also.

13 For those reasons, in my view, HXXg WXX WX has not established a seriously arguable claim to a caveatable interest that would entitle him to priority over QinXXi ChXXg’s interest as chargee. However, that is not entirely an end of the matter. Order 10 is in a different plight, as it was designed as a means of execution to enforce a judgment in respect of an unsecured debt, not to create a beneficial interest in the property or its proceeds. It was not sought in the amended statement of claim, but was included in the short minutes as a means of endeavouring to facilitate enforcement of the judgment for the unsecured sum. A writ of execution issued out of the Registry against assets of Ms ChaXXll could not prevail against a beneficial interest of HXXg WXX WX in land in her name, and by analogy, there is no reason why order 10 should prevail against such an interest.

14 It seems to me that the convenient way of addressing this situation is to require that a fund – and I have in mind $400,000, although I will hear the parties on that – be set aside from the proceeds of any sale, insofar as they exceed the amount required to discharge the Westpac mortgage and QinXXi ChXXg’s charge, which sum shall be preserved pending determination of whether HXXg WXX WX, in fact, has a beneficial interest in the property.

15 It will then be necessary for directions to be made for the resolution of that issue. The issue is obviously intertwined with the issues which will be addressed in the Family Court, and there would seem to be two alternatives. One would be for the Family Law proceedings to be transferred to this Court and this Court could then unquestionably determine all the issues – both the Family Law issues and the equitable issues. Another possibility would be for QinXXi ChXXg to be joined as an affected third party to the Family Law proceedings. It will be necessary for the parties to consider which of those courses might be preferable.

16 The order that I would propose, subject to hearing from the parties, is that upon the plaintiff undertaking to the Court that, upon completion of the sale of the property situate at and known as XX Bayview Street, Tennyson Point, being the land comprised in folio identifier 1XX/XX03228, he will pay into Court to the credit of these proceedings from the proceeds of sale insofar as they exceed the amounts referred to in Orders 8 and 9 of 28 May 2009 and insofar as they are adequate to do so, the sum of $400,000, order that the second defendant, by 22 September 2009, withdraw caveat AE737XX0N. As the effect of that order will be to give HXXg WXX WX partial interlocutory relief, it should be made upon the second defendant giving to the Court the usual undertaking as to damages.

17 I will hear the parties as to the sum of $400,000, and the future of these proceedings.

[Mr Morahan said that he would have to seek instructions as to the undertaking. Mr TreXXnza said that he would also have to seek instructions.]

18 I make no formal order at this stage. I adjourn the proceedings to Tuesday, 22 September 2009, at 2 p.m. I direct that the second defendant use his best endeavours to notify the first defendant of the appointment for hearing on 22 September 2009.

Tuesday, 22 September 2009

19 As I have mentioned in previous judgments given in these proceedings, there are on foot in the Family Court of Australia proceedings between the first defendant wife and the second defendant husband for adjustment and settlement of their property interests consequent upon the breakdown of their marriage. On what the Court is presently informed, it seems likely that a substantial part of the property of the matrimonial parties available for division between them, if not practically all of it, will be comprised by their interest in the property at XX Bay View Street, Tennyson Point, or in the proceeds of its sale. Other than the interests of Westpac as mortgagee, and the interest which in the substantive proceedings, I held that the plaintiff had as a result of the use of his funds to reduce the Westpac mortgage, the claimants to any surplus from the proceeds of sale are potentially the first defendant wife, who is the legal owner, the second defendant husband, who claims to have a beneficial interest, and who will also have a claim pursuant to the (CTH) Family Law Act 1975, s 79; and the plaintiff, as an unsecured creditor for so much of the judgment in his favour in these proceedings as is not the subject of a charge on the property ranking in priority to the claims of the husband and the wife.

20 The interlocutory regime that, on the last occasion these proceedings were before me, I indicated I proposed to implement, will preserve a sum which ought to be sufficient to provide for the husband’s claim, should it ultimately succeed. That fund will be preserved as funds in this court. The competing claims to that fund will involve, at least to some extent, consideration of facts proved or traversed in the evidence already given in these proceedings. As a creditor, albeit an unsecured one, the plaintiff in these proceedings has a significant interest in that fund, moreso as an order has been made which, in effect, entitles him to appropriate it by way of execution.

21 While it is entirely a matter for the Family Court of Australia as to whether the matrimonial proceedings should remain in that court or be transferred to this court, there would – at first sight at least – seem to be economies in use of judicial time if all these issues were resolved in the one court, and in the court that is already seized of a large part of them.

22 Upon (1) the second defendant by his counsel giving to the Court the usual undertaking as to damages, and (2) upon the plaintiff, by his counsel, undertaking to the Court that upon completion of the sale of the property situate at and known as XX Bay View Street, Tennyson Point, being the land comprised of folio identifier 1XX/XX03228, he will pay into court to the credit of these proceedings so much of the proceeds of sale as exceeds the amounts referred to in orders 8 and 9 of 28 May 2009, up to a maximum of $400,000.

23 Order that the second defendant by 23 September 2009 withdraw caveat AE 737XX0.

24 Prima facie, it seems to me that both parties have had a measure of success on the present application, and there should be no order as to costs of the application.

[Counsel addressed on costs.]

25 I remain of the view that there should be no order as to the costs of the notice of motion filed 21 August 2009.

**********

1300 91 66 77

1300 91 66 77

首页

首页